Click and Collect, Ship from Store, Ship to Store, Drop Shipping, Buy in Store-Ship to Home, Endless Aisle, Ship to Locker, In Store Return of Online Orders, etc.

The list goes on ! There are so many diverse services offered to customers to handle their omnichannel purchasing. The creativity from retailers and software companies seems limitless and it’s for a good reason : the competition is strong, customers want their purchasing experiences to be simpler, faster, pleasant and above all, they want to be able to combine physical and digital channels at any time in their purchasing journey. In this context, retailers must find innovative ways to respond to their needs.

IMPORTANT SERVICES BUT NOT EASY TO IMPLEMENT

For the retailer, these are strategic initiatives. They usually involve significant investment, require a strong commitment from the company and are highly visible in-house and to the customers as well of course.

For this type of project you cannot afford to make a mistake. Offering a new omnichannel service and not being able to meet your obligations might be more prejudicial than not doing anything at all.

Imagine if you make an online order for several goods and that you choose the « store pick-up » option. You arrive at the store but the package is not ready and you have to wait to collect it. In the end, this experience took longer and was more complicated than if you had simply purchased the goods at the store directly.

This might be why many retailers are still asking themselves such basic yet perfectly legitimate questions. Should they launch this project or a different one ? Is the investment worthwhile ? Will it boost sales ? What impact will it have in terms of profits ?

A BUSINESS CASE AS A DECISION-MAKING TOOL

The best way to answer all these questions is without a doubt to develop a rigorous business case. It can be executed rather quickly but it requires rigor and methodology. It presents multiple objectives :

- Make sure that all company departments which are affected by the new service understand the pursued objectives, financial needs and expected outcomes ;

- Accelerate the decision-making process ;

- Offer a monitoring tool to stay the course throughout the project while still focusing on the initial objectives ;

- Rationalize discussions regarding the project by addressing it in financial terms and via clear metrics.

WHO SHOULD BE INVOLVED IN THE EXECUTION OF A BUSINESS CASE ?

Various people and/or departments are involved in omnichannel order processing. It is therefore not easy to establish who would be the sole « owner ». The best thing to do is to define a RACI matrix1 which will be specific to the company but where the roles will usually be the following :

- The sponsor – which can be the e-commerce Vice President, even sometimes the CEO according to the company and its size,

- Business VPs of each concerned departments – including certainly retail operations VPs,

- IT and Project Managers,

- The finance department and

- A Steering Committee especially set up for this project.

This matrix enables to clarify the roles of every person for the various components of the study (analysis of benefits, costs, risks and financial analysis, alignment, etc.)

THE « ELEVATOR PITCH » OF THE PROJECT

Every type of omnichannel order processing evaluated in the study must be described in one short sentence. This is called the Elevator Pitch. This is an important task because it will serve as a compass to stay the course all throughout the project in relation to the initial commitment. This is what the layout looks like :

We offer the service [purpose of the program] with the aim of [purpose of the improvement], measured in terms of [metrics] and valued to [amount] €.

For instance :

We offer the service [ship from store] with the aim of [reducing the inventory of unsold goods while increasing customer delivery], measured in terms of [delivered products from stores but unsold in them] and valued to [amount to be defined after financial analysis] €.

The same task will be done for other studied departments. For instance to describe the installation of endless aisles available via store booths, the main goal would be to « save the sales » and so on for all the considered services.

IDENTIFY AND MEASURE THE BENEFITS

It is important to think about the benefits from both the retailer’s and the customer’s point of view. Some benefits such as those related to brand image and brand differentiation from the competition, must, of course be noted but they are also difficult to quantify. It is therefore important to focus on all matters associated with the optimization of revenues, cost reduction and business efficiency.

Besides the improvement of the customer experience, direct financial benefits can be derived directly from the implemented programs.

For example, a « buy online-pick up in store » program could generate additional sales once the customer will go to the store to collect his purchase.

A « ship from store » program will enable the reduction of necessary working hours in the distribution center and might optimize the activities of in-store sellers. They will then be able to process online purchasing deliveries allocated to them.

IDENTIFY AND MEASURE THE COSTS

It is important to identify as exhaustively as possible ALL costs (e.g. CAPEX and OPEX) related to the implementation of the program.

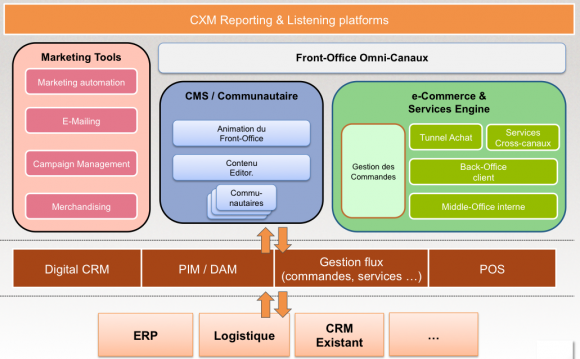

In this type of program the most important duty is quite often the implementation of an OMS system to manage omnichannel orders.

The costs structure and staggering will be very different from the implementation of an on-premise solution vs. a cloud approach – cost of entry, speed of implementation… Integration costs, necessary internal and external resources, not to mention the maintenance costs will be analyzed. Measuring the financial impact for a minimum period of 3 years is important for this type of model.

As a reminded the leading OMS solutions providers are : Manhattan Associates, IBM, Magento, SAP Hybris, Oracle (following the acquisition of Micros Systems, Micros Retail CWSerenade provider), NetSuite, OrderDynamics, Jagged Peak, Kibo (formerly Shopatron).

Training should not be disregarded either. For example, training in-store staff in new « ship from store » practices while you manage a network of over 500 stores is not insignificant !

STUDY THE ADAPTABILITY OF ENVISIONED SOLUTIONS

Any implemented solutions will bring its fair share of immediate benefits, however some benefits will come out later and only in the occurrence of certain events. This is the solution’s adaptability.

For instance implementing a new OMS system will immediately allow customers to use omnichannel order processing for the whole existing store network. This is an immediate benefit. But in case the store network expands in the future, omnichannel order processing could be achieved in new stores very quickly and for a limited marginal cost. This is the solution’s future benefit.

The same reasoning goes for the progressive activation of omnichannel order processing provided in native mode by the main OMS solutions. You probably won’t activate all of them upon initial setup but you might activate some later.

IDENTIFY AND MEASURE ALL RISKS ASSOCIATED

« No margin for error » like I previously said. Yet making mistakes is always a possibility and risks do exist. It is therefore important to identify and measure them, try reducing them but also anticipate actions to be carried out in case a problem occurs.

The three main categories of risks are those associated with the project, the solution providers and the adoption of implemented programs.

Project risks : the project’s scope is critical. If it is defined in overly broad and ambitious manner the project risk will be increased tenfold. It is recommended to implement one service at a time, taking the time to test everything and executing pilots first.

Provider risks : the digital architectures have become extremely complex. Many building blocks co-exist and interact. Choosing the right solutions, evaluating providers’ offers, seeking advice from digital architectures experts, talking to peers, are so many examples of good practices to promote. A rigorous technological guidance is recommended.

Adoption risks : adopting new programs by the in-store sellers’ teams is essential for the program to be successful. To reduce such risk you need to be creative. For instance as part of the implementation of a « ship from store » program, you could award store managers with a bonus – including both in-store sales AND online purchase orders processed from the store. This could motivate and encourage new practices.

INTEGRATE BENEFITS, COSTS, RISKS AND ADAPTABILITY IN A FINANCIAL EVALUATION

Once the various aspects of the business case have been analyzed the objective is to integrate new financial components.

Benefits and costs can easily give a first indication of the return on investment (ROI) for each evaluated program.

The use of scenarios (optimist, pessimist) also allows quite easily to balance out the ROI in order to take into account the identified risks.

Highlighting in financial terms the adaptability of a solution is less obvious. A parallel can be drawn with the mechanism used for the valuation of options as financial instruments. As a reminder an option is a right entitling its holder to make a transaction (for example buying or selling a stock option) at a given due date and for a pre-determined fixed price – we call those exercising an option, exercise date and exercise price). Given the uncertainty around the markets (we don’t know the future stock price associated with the option) this right per se holds a certain value.

Keeping this analogy in mind and applying it to our example in choosing an OMS, we can say that choosing today a solution that can activate several services for omnichannel order processing – which we don’t necessarily need right now but could become valuable in the future, is equivalent to buying today an option that could be exercised at a later time for a limited marginal price (potential right to activate the service, staff training…) in order to reap the benefits.

The financial valuation of adaptability is possible by borrowing certain techniques associated with the financial theories of options but let’s be honest, our intention here is not to build complex financial models – unless your company is mature enough regarding this type of approach. The important thing here is to realize how important the notion of adaptability is and how anticipating for future business scenarios is valuable, so that it can be taken into account when you will have to decide between several technological scenarios.

It must be emphasized that this type of business case is especially useful to bring to the table the various team members of a project, to ensure that everyone is speaking a common language in order to reach an agreement on the merits (or not) of engaging the company towards such or such scenario regarding omnichannel order management.

The best way to apply all of these techniques will be with the support of an expert advisor which will act as a facilitator and contribute to the execution of the business case.

These techniques will later be used in several other evaluation investment scenarios for digital transformation projects.

- for Responsible, Accountable, Consulted, Informed ↩