China is the world’s biggest e-commerce market, totaling US$ 1,328.59 billion in 2018, up by 23.9% year-on-year. And its remarkable growth is not expected to slow down yet.

These sales are largely driven by leaders’ Alibaba’s Taobao, Tmall or JD.com, which you have probably heard of. But the e-commerce ecosystem is much more diverse than it seems. For example, from 2015 to 2018, Alibaba’s share of e-commerce sales in China fell from 77.6% to 53.5%. The market diversified a lot these last few years and it’s not easy to keep track.

China’s e-commerce ecosystem can offer plenty of opportunities for international brands to enter the country without having to set up a physical base. Even for brands who are planning to launch retail operations in China, cross-border e-commerce can be a good way to test the market and collect data on Chinese customers, in order to adapt their brick-and-mortar strategy. So which are the cross-border e-commerce platforms you should consider?

Let’s have a better look on the e-commerce ecosystem in China. We have chosen six major apps and websites you might consider when entering the online Chinese market.

Kaola

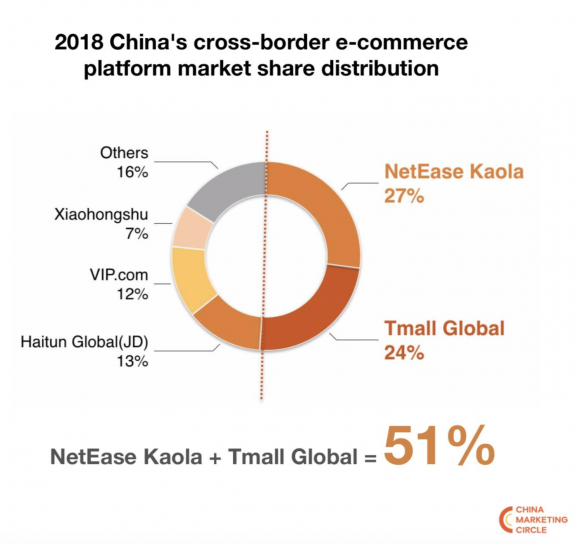

According to market share, Kaola.com is the leader among online cross-border retail platforms (21,4% of the total market share), before both JD and Tmall. It was launched by NetEase in 2015.

Kaola focuses on select, high-quality overseas goods.They target the middle-class Chinese in their 30s, which have an increasing purchase power.

They also addressed one pain point of Chinese consumers by greatly reducing the delivery time compared to competitors: Koala’s expeditions take only 1 to 3 days thanks to warehouses in several free trade zones and in different places abroad.

Kaola focuses a lot on food and beverage but also provides a large range of products in baby and maternal care, healthcare, beauty, and cosmetics, including foreign brands such as Nescafé, Evian, or Philips.

Advantages:

- Kaola can buy products directly from foreign companies, offering the opportunity to save costs and reduce the hurdles dealing with distributors

- Brands can achieve analysis service from Kaola.com after cooperating with the platform

- Companies get relatively quick payments as Kaola can rely on NetEase’s cash resources

What to keep in mind:

- Kaola charges significant costs, which are similar to other big marketplaces such as Tmall or JD (initial deposit, commission, yearly membership fee)

Xiaohongshu, also known as RED

Xiaohongshu is also a mobile app which was launched in 2013. You may have heard of it as RED, as xiǎohóngshū means “Little Red Book”. Xiaohongshu is more than an ecommerce platform: it is the first app that successfully managed to fuse social media with e-commerce.

Xiaohongshu was originally conceived of as an app for Chinese consumers travelling abroad to post recommendations about overseas products. It evolved in 2014 by opening RED Mall, to cater those who wanted to buy these luxury international items – primarily fashion and beauty products. However, it kept the characteristics that had attracted users to the app in the first place: a social network and authentic, trustworthy reviews.

By January 2019, Xiaohongshu says it has over 200 million registered users, mainly targeting working women between 18 and 35 years old – keen on sharing their experience and looking for suggestions and product reviews.

Advantages

- Through the community, products are easily and naturally promoted among users

- The cross-border trading is one of the main businesses

- Chinese certifications are not necessary to open a store

What to keep in mind

- The app focuses on luxury goods from overseas – primarily fashion and beauty products – directed at female consumers

- You can only open single-brand stores

VIP International

VIP.com (or Vipshop) was founded in 2008 and is the largest flash sale site in China and the whole world. In 2014, it launched VIP International to focus on products coming from overseas, while you can find Chinese products on the original site. VIP International is currently the third biggest site in terms of cross border sales, after Kaola and Tmall Global.

Their model consists in pre-ordering products (often from excess inventory) and resell them with a significant discount. It provides short shipping lead time and lean delivery services, and has so far 12 warehouses overseas and 11 in China.

Advantages

- VIP.com has a strong recognition in China

- VIP.com has rolled out a WeChat mini-program store feature

- Products are pre-purchased and you’re not subject to any membership fees, commissions, deposits or listing fees

What to keep in mind

- You will need chinese certificates (e.g. tax registration certificate, organization code certificate)

Pinduoduo

Pinoduoduo is the 2nd the most popular e-commerce app in China, after Taobao. It was launched as a mobile e-commerce platform in 2015, and is said to have reached 200 million users in 2018.

Pinduoduo’s biggest point of difference is their unique business model which consists of “group shopping”. By sharing Pinduoduo’s product information on social networks like WeChat, users can invite their contacts to form a shopping team to get a lower price for their purchase. Based on group orders, the platform will make orders directly from manufacturers, reaching very competitive prices.

This bulk-selling model allow the platform to offer good deals and provide users with an interactive and social shopping experience. Other incentives such as coupons and free products contributed to the success of the platform, which soon became a viral sensation in China.

Pinduoduo offers a wide range of products from daily groceries to home appliances.

Advantages

- The process of opening a store on Pinduoduo is quite easy: you can directly apply on the website and the approval process only takes two working days

- Pinduoduo offers free analysis for your customer base and marketing activities

- The ‘Duoduo Campus’ provides different lessons for the users (such as marketing, design and photography courses)

What to keep in mind

- Users are attracted to extremely low prices: the average order on Pinduoduo is 6 USD, against 30 USD on Taobao/Tmall and 60 USD on JD.com.

- Pinduoduo demographic is largely from third- or lower-tier cities, and mostly senior citizens

- There are five things you need to acquire before applying: a Chinese Business License, an Organization Code Certificate, a Tax Registration Certificate, an Account Opening Certificate and a Chinese phone number

Secoo

If your company belongs to the Luxury sector, Seeco is the platform to look at. Facing Alibaba’s and JD’s luxury portals (respectively Luxury Pavilion and Toplife), which have taken up a large portion of China’s online luxury retail pie, Secoo has managed to stand out.

Founded in 2008, Secoo specializes in luxury clothing and accessories for men and women from big-name brands, including Chanel, Louis Vuitton, Hermes, Gucci, and many more.

It started out as an online marketplace for (often used) luxury items, and has since expanded its offering with upscale lifestyle products and services, such as reservation services for luxury hotels or travel packages.

Secoo is committed to provide an omnichannel experience, with the opening of brick-and-mortar stores in major cities in China, as well as around the world – such as in Hong Kong, Milan, or New York.

Advantages

- Secoo benefit from a great image as a source of authentic luxury items (as counterfeit items are still a strong issue in China)

- Secoo provides high-quality service, such as same-day delivery of big-ticket items by suited, white-gloved couriers

What to keep in mind

- Secoo is dedicated to high-end products and services only, and is not the platform to look at if your company do not belong to the luxury sector

yMatou

YangMatou (or yMatou) was founded in 2009, and is a cross-border e-commerce platform for C2C and B2C product, C2C meaning that the platforms allow trading between Consumer to another Consumer – in a similar way to eBay or Taobao. Their B2C products activities focuses on high quality products from overseas.

It is a comparably small cross border e-commerce website, with a narrow product range: baby products, beauty products, nutrition, clothes, shoes and bags. Like Vipshop, its business model consists in pre-purchasing products directly from overseas.

Advantages

- Entry requirements are low compared to other websites

- Setup fees and running costs are generally lower compared to other platforms

- Products are pre-purchased so you don’t need to manage marketing, customer support, claims & refund

What to keep in mind

- The product range is narrow. The main product categories include mom & baby products, apparel, accessories, beauty products, and cosmetics

- The company mainly targets young female buyers

Conclusion

The presentation of these six China’s e-commerce platforms is only a glimpse of the opportunities offered to foreign brands. As the cross-border online e-commerce is expected to grow more, the ecosystem will become even more complex. There was 649.57 million e-commerce users in China in 2018, who spent $899.06 USD online annually. They are expected to be 931.9 million online shoppers who will spend $984.91 USD in 2022.

This fast evolution, combined with the Chinese consumers’ tendency to be at the forefront of new innovations (for example, 44% would consider a drone as a delivery method for a low value product versus 22% globally.) can only make us wonder what the future of China’s online market will look like. So, are you ready to jump on the bandwagon?

Note: As we wrote these lines the news came out that Kaola got acquired by Alibaba. This USD 2 billion deal gives Alibaba an impressive dominant place in the Chinese e-commerce market.